When Should You Withdraw Money from Retirement Accounts?

Written By: Brian Ellenbecker, CFP®, EA, CPWA®, CIMA®, CLTC®

Retirement accounts like IRAs, Roth accounts, 401(k)s and 403(b)s are popular savings vehicles many people leverage as a part of their retirement savings plan. There are different tax benefits available, depending on which kind of account you decide to save to.

When to start withdrawing money from these accounts is a key planning opportunity. Taking distributions at optimal times in your life can potentially lower your lifetime tax liability—sometimes by a significant degree. Let’s explore some of the most common opportunities retirement account owners might encounter. The focus of this article will be on qualified retirement plans, which include traditional IRAs, 401(k)s, 403(b)s, 457s, Sept IRAs and SIMPLE IRAs.

Taxation of Distributions from Qualified Plans

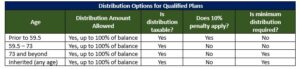

Distributions from qualified plans are permissible at any age. When withdrawn, they are typically taxed as ordinary income. Prior to 59.5, distributions are also subject to a 10% early withdrawal penalty. When you reach age 73 (increasing to 75 for those born in 1960 or later), required minimum distributions (RMDs) begin. The below table summarizes the taxation of distributions at various ages:

Possible Reasons NOT to Take Optional Distributions

Distributions are fully taxable. The possibility of paying taxes sooner than required is something many people try to avoid. They prefer to defer taxation for as long as possible.

Distributions move you into a higher tax bracket. When combined with other income, if a large enough retirement distribution would cause some of that income to be taxed at a higher marginal rate, it might make sense to delay withdrawals until a time when your tax bracket is lower.

More of your Social Security becomes taxable. If your modified adjusted gross income (MAGI), is above $34,000 for single filers or $44,000 for joint filers, 85% of your Social Security is subject to income tax -the maximum amount under current law. If your income is below those thresholds, less of your Social Security is subject to tax. If you take a retirement account distribution it may increase your income over those limits and more of your Social Security will be subject to tax. In this case, a $1 withdrawal causes $2 to be subject to tax (the withdrawal itself plus more of the Social Security benefit). If you are in this situation, the marginal rate is likely to be much higher than it will ever be for you, so a withdrawal is unlikely to be beneficial.

Medicare premiums could increase. Medicare premiums are means-tested and increase as your income passes certain thresholds. A retirement withdrawal could subject you to these higher premiums, also known as the Income-Related Monthly Adjustment amount, or IRMAA. In 2023, IRMAA starts once your modified adjusted gross income from two years prior exceeds $97,000 for individuals or $194,000 for couples. If your retirement account distribution pushes you into this income range or into a higher IRMAA tier, the cost of the distribution increases beyond just the tax cost.

The distribution might push you into a higher capital gains rate. Long term capital gains and qualified dividends are taxed at 0%, 15%, or 20%, depending on your taxable income. Distributions increase your taxable income, which could in turn increase your capital gains rate. Single taxpayers with adjusted gross income above $200,000 or couples over $250,000 pay an additional 3.8%. Additional income could subject your capital gains or qualified dividends to a higher base rate and could subject any of your investment income over the $200,000/$250,000 to an additional 3.8% tax.

You could lose other tax benefits. Additional income could cause you to become subject to the phaseout or elimination of certain tax credits or deductions. You could also be phased out of being able to make Roth IRA contributions, if you’re still working.

You need to withdraw additional funds from your retirement account to cover the taxes on the distribution. Having to take an additional withdrawal further reduces the amount in the account to grow tax-deferred. A circular tax liability also starts, as that additional distribution for taxes is also subject to income taxes itself.

Possible Reasons to Take Optional Distributions

You’re charitably inclined and are 70.5 or older. If you make donations to charity and are at least 70.5, you can take up to $100,000 from an IRA and donate it to charity tax-free. This withdrawal is referred to as a qualified charitable distribution (QCD). A QCD is tax-free and does not increase AGI or taxable income. If you’re subject to RMDs, a QCD also counts towards satisfying that obligation.

You want to do a Roth Conversion. Shifting funds from your Traditional IRA to a Roth IRA is known as a Roth conversion. The goal is to pay taxes on the Traditional IRA sooner than you have to, but hopefully at a lower rate. Then, any money in the Roth IRA grows tax-free for as long as it remains in the account. One of the main reasons to consider this strategy is if you expect to pay tax at a lower rate at the time of a conversion, than in the future when you would have to withdraw the money from your IRA. Doing so can also help reduce future RMDs by reducing your Traditional IRA balance now. RMDs are not required from Roth IRAs until they are inherited. Before performing a Roth Conversion, it is recommended that you consult with your financial and tax advisors to ensure this strategy makes sense when considering your personal circumstances.

You want to try to reduce future RMDs and manage taxation over your lifetime. Taking distributions from your retirement account can help reduce future required distributions. By taking distributions now, the balance in the retirement account will likely be lower once distributions are required to be taken. By spreading distributions out over a longer period of time, you may be able to better manage the taxation of those distributions, which could result in a lower overall lifetime tax bill. It could also help you better manage Medicare premium increases due to IRMAA, taxation of Social Security, and maximizing deductions and credits, to name a few.

Preparing for future tax code changes. While current tax law is set to revert back to pre-2018 law starting in 2026 and likely increase the tax liability for most people, it is not guaranteed to happen, as Congress could step in and make changes. Tax laws could also change down the road. By shifting funds from a pre-tax retirement to a Roth account, or even a taxable investment account, you increase your tax flexibility which could result in better planning opportunities down the road. Oftentimes, you hear about diversifying your investments to manage risk. You also want to diversify the tax treatment of your accounts to maintain flexibility and help manage the unknown of future tax law changes.

Estate tax planning. With the current estate tax exemption at almost $13 million per person ($26 million for married couples), very few people have to worry about estate taxes at the moment. The exemption is scheduled to be cut in half in 2026. Additionally, it’s possible Congress could reduce the exemption further, depending on which party is in control, budgetary needs, or any number of other possibilities that might pop up down the road. The resulting income tax from a retirement account withdrawal reduces the size of your estate. Income tax rates are typically lower than estate tax rates, which allows you to take advantage of this tax-rate arbitrage. You could then potentially use these funds for additional estate planning, like making gifts to family members.

You need money for spending. If you have a spending need, whether it’s a larger one-time expense (travel, asset purchase, education, business investment) or to help meet your general spending needs, you may want or need to pull funds from your qualified retirement account. Try to do so in the most tax-efficient manner, but if you need the funds and that’s your only option, take it. You saved for all those years so you could spend the money when you need it.

Determining when to withdraw funds from your qualified retirement account can be a complicated decision that involves many different components in your life. Reach out to your Shakespeare financial advisor, as we are here to be your trusted partner through these planning decisions. We are more than happy to discuss the different strategies available to you.