Understanding the Student Loan Relief Plan

Written By: Brian Ellenbecker, CFP®, EA, CPWA®, CIMA®, CLTC®

This article was written August 2022.

On August 24, President Biden signed an Executive Order providing student debt relief to potentially tens of millions of borrowers. There are several components to the Executive Order. While the student loan forgiveness grabbed the majority of the headlines, there are several other relief provisions that were included.

The key relief provisions contained in the Executive Order are:

Student Loan Forgiveness

The Order forgives up to $10,000 in student debt. That maximum is increased to $20,000 if the borrower also received a Pell Grant. To clear up a bit of confusion when this was first announced, the extra money is not for Pell Grant repayment. It is extra forgiveness on student loan balances because the person received a Pell Grant.

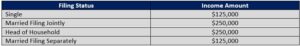

To qualify for this forgiveness, your income must be below the following thresholds:

The income amount is expected to be based off Adjusted Gross Income (AGI).

Current students who are claimed as a dependent will use their parent’s income for the purposes of the income test.

You can use either 2020 or 2021 income, but 2022 income will NOT count. If your income was below the threshold in at least one of those years, you would qualify for forgiveness. It appears that these thresholds are a “cliff”, meaning if you go over them by even $1, you lose eligibility for forgiveness.

In order for the loan to qualify for forgiveness, it must meet certain requirements:

– The loan must have been obtained prior to July 1, 2022.

– Federal student loans qualify. Private loans do not.

– Parent Plus loans are included in the forgiveness plan.

– Undergraduate and graduate debt is eligible for forgiveness. Qualifying loans used for trade school are also eligible.

– Current students are eligible, as long as the loan was taken out prior to July 1.

– The Department of Education is also working on a plan to include privately-held Federal Family Education Loans (FFEL) in the program.

The forgiveness will be tax-free at the federal level. At the state level, things are a bit more complicated. Depending on your state’s law, it could either be tax-free or taxable. To get a better handle on whether this loan forgiveness will be taxable in your state, click here. For Wisconsin residents, the state Legislature would need to pass a law to exclude this debt forgiveness from being taxed. If that does not happen, current law would require you to include the debt forgiveness in your Wisconsin income.

When will the relief be granted and do you have to do anything to receive it?

The Department of Education is being tasked with managing the forgiveness process. Specifics on how the forgiveness process will work should be released in the coming weeks.

We do know that for the roughly 8 million qualifying borrowers who are on income-driven repayment plans and for whom the agency already has income information, they will get automatic debt relief. They are not expected to need to take any action. The remaining 35 million borrowers will have to attest that their income is below the threshold.

It’s likely this income verification will be done online through the Department of Education’s website. The DoE is targeting to have the forgiveness form available in October. Loan balances are expected to reflect the forgiveness within four to six weeks of completing the application. The deadline to submit a forgiveness application is December 31, 2023.

If forgiveness does not pay off your entire loan balance, whether or not your monthly payment going forward will be impacted depends on your payment plan. If you are enrolled in an income-driven repayment plan, your payment will not be reduced because of the forgiveness. The payment is based on your income, not your loan balance. Other borrowers whose payment is based on the loan balance should see their payment drop.

How much forgiveness can a family receive?

If a married couple with one child has a Parent Plus loan with at least a $10,000 balance and the child is a Pell Grant recipient with at least $20,000 in loans, $30,000 of debt would be forgiven. This assumes they are under the income thresholds.

If you made loan payments during the payment pause (beginning March 13, 2020), you may contact your loan servicer to request that your payment be refunded. Loan servicer contact information can be found by clicking here.

Student Loan Debt Payment Moratorium Extended

The current moratorium on Federal student loan payments and the 0% interest rate were both set to expire at the end of August. They have been extended through December 31, 2022. The White House has stated that this will be the last time that these provisions will be extended.

Plan to start making loan payments on any remaining balances in January.

Changes to Income-Driven Repayment Plan

A new income-driven repayment option is being introduced. The downside is that it adds a sixth repayment option, but the upside is that it will offer a big improvement for many borrowers. The changes include:

– Maximum annual payments of 5% of discretionary income for undergraduate

– Maximum annual payments of 10% of discretionary income for graduate

– New baseline for non-discretionary income of 225% of the Federal Poverty Line, up from the current 150% in most instances.

– Balances won’t increase as long as monthly payments are made on time

– Loan balances will be forgiven after 20 years of payments. If the original loan balance was $12,000 or less, they will be forgiven after 10 years of payments.

These changes will be ongoing for the next few months. Reach out to your Shakespeare advisor with questions on your current situation. We are here to be your partner through this process.