Advantage vs Supplement

The first step in evaluating if you should enroll in Traditional Medicare or a Medicare Advantage plan is knowing there is a DIFFERENCE!

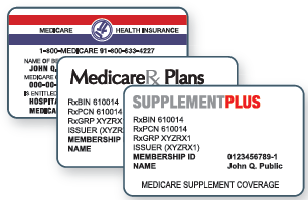

You’ll remember from my last Medicare blog, that my father in-law, Bob, chose to enroll in: 1). Traditional Medicare; 2). a Medicare Supplemental Plan; and 3). a Medicare Part D Prescription Drug plan.

His alternative to this three step process was to enroll in one Medicare Advantage plan, which would replace all three of these plans. Sounds easier, right? That was the opinion of two representatives that Bob called regarding the subject. I received this text from him: “I’m healthy, don’t need Medicare or Supp, just Advantage, it is cheaper.”

Whoa, Bob. Slow down… let’s look at the differences between Traditional Medicare and Medicare Advantage.

MEDICARE ADVANTAGE

The good stuff:

- You have one policy that covers Traditional Medicare, costs that Medicare doesn’t cover, and prescription drugs.

- Premiums can be less expensive.

- You will have co-pays and out of pocket expenses throughout the year, which means bills sent to your home.

The not so good stuff:

- Your doctors and other providers will be limited to just those in the plan’s network. If you decide to go to a provider out of network there may be only partial or NO coverage.

- Networks are tied to your geographic area. If you are on vacation or spend part of the year in a different state, your coverage may be very limited or nothing.

- The plan can change its network each year, which means you may have to change providers in order to have coverage.

- The plan can change the annual limit on out of pocket costs (limited to the federal maximum), which makes it is more difficult to predict your health care expenses each year.

- If you have been on a Medicare Advantage plan for more than 12 months, it ISN’T easy to switch back to Traditional Medicare. If you apply for a supplemental policy outside of your Initial or Special Enrollment period (remember that is either the 7 month period surrounding your 65th birthday or within 8 months of losing other group coverage) you are subject to medical underwriting.

TRADITIONAL MEDICARE

The not so good stuff:

- You may need 3 polices (Medicare B, Supplement, and Prescription Drug Plan).

- Your premiums may be higher than an Advantage Plan.

The good stuff:

- Your out of pocket expenses may be lower during the year with little to no co-pays or out-of-pocket expenses.

- You can more easily predict your health care expenses each year.

- You can see any doctor, hospital, or provider that accepts Medicare patients anywhere in the country.

- You are guaranteed coverage as long as you enroll during your initial enrollment or special enrollment period.

As with any type of insurance, if you can tell me exactly when you’ll need care and for how long, I can tell you which type of coverage to have.

If you plan to be healthy, not see many doctors, and don’t plan to travel, you may want to consider an Advantage plan. Oh, and make sure you remain organized and interested in this stuff throughout retirement so that you can

- Budget for your maximum out of pocket expenses each year

- Make sure your network hasn’t changed so that you can continue to see your doctor and have coverage

- Pay your medical bills.

If you are less sure how much medical care you may need in retirement, but want to be more sure about your health care costs each year, not worry about your providers being in network or having coverage when you travel, and have less medical bills to remember to pay, you may want to consider Traditional Medicare plus a supplement plan.

My father in-law opted for Traditional Medicare and a Supplement. He decided that he’d rather NOT spend his retirement worrying about medical bills and networks and spend more time traveling and enjoying his family. As his family, I appreciate that.

The choice is yours.