Drawdown Strategies in Retirement

Written By: Brian Ellenbecker, CFP®, EA, CPWA®, CIMA®, CLTC®

As people approach retirement, one of the most common fears is how they will replace their regular paychecks. There can be uncertainty around how to structure income in retirement. Fortunately, there are numerous ways to replicate your paycheck with a combination of Social Security, account withdrawals and possibly other income sources like pensions and deferred compensation.

The sources of income available will vary from person-to-person, which is why it’s important to make sure you develop an income plan specific to your circumstances. The focus of this blog will be structuring your investments to provide you with the supplemental income you need to meet your expenses in retirement.

While there are many variations of retirement distribution strategies available, we’ll focus on four of the most common strategies.

4% Withdrawal Rule

The 4% rule states that you withdraw 4% of your retirement savings in the first year of retirement. In future years, you increase your initial withdrawal amount by inflation. Why 4%? Academic research supports the idea if you withdraw an inflation-adjusted 4% for 30 years, the probability is very high that your portfolio would be able to support that. It’s best to consider it as a “rule-of-thumb” to what you can withdraw. Your personal sustainable withdrawal rate could be higher or lower depending on a number of factors.

For example, if you have a $1 million portfolio, you would withdraw $40,000 (4%) in the first year. Next year, if inflation is 3%, you would withdraw $41,200. If inflation remains at 3%, you could withdraw $42,436 in the third year, $43,706 in the fourth year, and so on.

Advantages:

– Longstanding retirement withdrawal strategy with a significant amount of academic research supporting the conclusion.

– Simple to follow.

– Predictable amount of income each year.

Disadvantages:

– Market volatility or unforeseen shocks to the system could increase the risk of running out of money if adjustments aren’t made along the way.

Fixed Percentage Withdrawals

Under this method, you withdraw a set percentage of your portfolio annually. The dollar amount you distribute each year will fluctuate based on the underlying value of your portfolio. If your portfolio increases in value, your annual distribution increases. However, if your portfolio falls in value, your annual withdrawal will decrease. There is a degree of uncertainty about how much income you will be able to take each year. However, if your withdrawal rate is less than the return you earn on the account, your principal and future income could increase. Conversely, if you withdraw an amount greater than what the account earns, you risk running out of money sooner than anticipated.

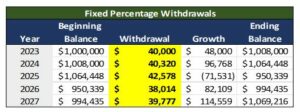

For example, if you have a $1 million portfolio and decide to withdraw 4%, your income would be $40,000 in the first year. In subsequent years, it will fluctuate based on how the value of your portfolio changes. A hypothetical 5-year projection might look like this:

Chart is for illustrative purposes only. Withdrawals are assumed to be taken at the beginning of each year.

Advantages:

– It is a simple formula to follow.

– Portfolio is assumed to not run out of money.

Disadvantages:

– Withdrawals fluctuate and could decrease if the portfolio value drops in a given year.

– Although the portfolio should not run out of money, the annual income could drop to a level where it no longer is able to support your desired lifestyle.

Fixed Dollar Withdrawals

Under this strategy, you simply take a fixed dollar amount out of the portfolio every year. If you have a $1 million portfolio, perhaps you decide you want to withdraw $40,000 per year. You might do this for the next five years, then re-evaluate the portfolio’s performance, your spending needs, and adjust the withdrawal amount for the next five years.

Advantages:

– Simplest rule to follow.

– Predictable income.

– Could make for easier tax planning by having predictable income.

Disadvantages:

– Lack of regular inflation adjustments.

– In down markets, you are liquidating a larger percentage of the portfolio.

“Buckets” Withdrawal Strategy

Under this strategy, you divide your assets into various buckets. The simplest version is to divide them into three buckets: cash, fixed income and equities. The cash bucket is where you will take your withdrawals from. Typically, this bucket will contain 2-5 years of living expenses. The second bucket holds fixed income securities, while the third bucket holds equities. As you spend down the cash bucket, you replenish it with investment earnings from the second and third buckets.

Advantages:

– Allows your longer-term investments to grow undisturbed for a longer period of time.

– More control and flexibility when deciding to replenish your cash bucket.

Disadvantages:

– More complicated, so might be more time consuming to implement.

– Requires more monitoring.

It is also possible to combine the above strategies to meet your needs, depending on your personal circumstances.

If you would like better understand the options available to you in your personal situation, reach out to your Shakespeare financial advisor. We are here to help analyze your needs and decide what strategy will meet your lifestyle as you move through your golden years.