Overview of the Coronavirus Aid, Relief and Economic Security Act of 2020 (CARES Act)

The global impact of the novel Coronavirus (COVID-19) has been significant. This global pandemic, as declared by the World Health Organization, has brought the economies of countries around the world to a grinding halt, as the world comes together to try to stop the spread of this disease and avoid overwhelming our health care systems. As “social distancing” and various degrees of “shutdowns” become the norm, many people and businesses are struggling to make ends meet.

In response to the significant economic harm that this virus has caused along with the stress on our healthcare system, Congress and President Trump signed the Coronavirus Aid, Relief and Economic Security (CARES) Act of 2020. The Act provides an estimated $2 trillion in assistance, including almost $500 billion in individual rebate checks, another $500 billion to support businesses and industries that have seen their operations affected, $400 billion in tax credits to businesses for wages and payroll tax relief, $300 billion to support various state and local governments and $150 billion to support the health care system.

Provisions for Individuals

Recovery Rebates

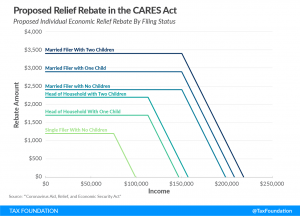

The section of the law that got the most attention was the idea of Recovery Rebates— payments being made directly to individuals and families below a certain income threshold. The rebate is an advance refund of a newly created 2020 tax credit. The rebate amounts are:

- $1,200 for an individual

- $2,400 for a married couple

- $500 for children under the age of 17

However, not everyone is entitled to a rebate. The amount of each check is phased out by $5 for every $100 in excess of a “threshold amount.” The excess amount is based on a taxpayer’s 2018 adjusted gross income (AGI) unless they have already filed their 2019 return—then it will be based on 2019 AGI. The threshold amounts are:

- $75,000 for single filers

- $150,000 for joint filers

- $115,500 for heads of households

Based on the phase out formula, the rebates will be completely phased out for single filers at $99,000 of AGI, $198,000 of AGI for joint filers and $136,500 for heads of households. However, if you have children, the amount of income you may have before the rebate is completely phased out will be higher, as shown on the graph below:

To better understand how much of a rebate you might be eligible for, let’s look at a few examples:

Example #1: John and Jane are married and file a joint return. They do not have any children and their AGI was $125,000. They will receive a rebate of $2,400.

Example #2: Tony and Jenny are married and file a joint return. They have two kids, ages 8 and 10. Their AGI is $140,000. They will receive a $3,400 rebate ($2,400 + $500 + $500).

Example #3: Dave and Audrey are married and file a joint return. They have two kids, ages 15 and 17. Their AGI is $145,000. They will receive a rebate of $2,900. ($2,400 + $500). Their oldest child is over the age of 16, so that child is not considered as a part of credit calculation.

Example #4: Tom and Monica are married and file a joint return. They have two kids, ages 12 and 8. Their AGI is $175,000. They will receive a rebate of $2,150 ($2,400 + 500 + 500 – $1,250 phaseout).

Because the advancement of this new 2020 tax credit is based on your income from either 2018 or 2019, you could still be entitled to a tax credit when you file your 2020 tax return next year if your income drops below the AGI threshold in 2020, even if your income was too high for the cash flow assistance provided by the immediate cash payment. While people in this situation will not receive the immediate help the provision is designed to provide, a credit will be available later on nonetheless.

Conversely, if your income was low enough to qualify in 2018 or 2019 but your income was above the threshold in 2020, the tax credit will NOT be clawed back when your 2020 return is filed.

It will probably be a month or more before payments will actually be received. The Treasury Department indicates that the “as soon as possible” guidance provided by the Act probably means payments will start to get into taxpayer’s hands in May. For people receiving Social Security, deposits will be made to the same account that the Social Security benefit is paid to. For taxpayers who provided direct deposit information on their 2018 or 2019 tax returns, payments will be sent to that account. Other payments will be mailed to the last known address on file. This process creates the potential for payments to be sent to accounts that are no longer active or potentially wrong addresses. The Act indicates that the IRS will send a confirmation letter within 15 days of having made the payment, which will provide a phone number to report any payment issues. Expect the process to remedy any errors to be less than efficient, to put it kindly.

No 10% Additional Tax for Coronavirus-Related Retirement Plan Distributions

A new exception to the 10% distribution penalty for pre-59 ½ distributions from retirement accounts was added. The CARES Act added an exception for “coronavirus-related” distributions of up to $100,000 made to a qualified individual.

A qualified individual is someone who:

- Is diagnosed with COVID-19

- Has a spouse or dependent who is diagnosed with COVID-19

- Experiences adverse financial consequences as a result of being quarantined, furloughed or laid off or having work hours reduced due to the virus

- Is unable to work due to lack of childcare because of the virus

- Owns a business that had to close or operate under reduced hours due to the virus, or

- Any other factor as determined by the IRS.

The plan administrator simply needs to rely on the employee’s word that they satisfy one of the above conditions in determining whether the distribution applies for this exception.

The key tax benefits associated with this new exception include:

- Exempt from 10% penalty. Distributions made to individuals under the age of 59 ½ will not be subject to the early distribution penalty, assuming the distribution meets the requirements of the fairly broad definitions of this new exception. They are still subject to the standard income tax rules.

- Not subject to mandatory withholding. Distributions taken from employer retirement plans will not be subject to the 20% mandatory federal tax withholding requirement.

- Can be repaid over three years. Anyone taking a qualifying distribution has up to three years to roll any or all of the distribution back into their retirement account. The funds can be returned as a single contribution or as a series of contributions made over the three-year time frame starting the day after the distribution is taken.

- Income may be spread over three years. The income from a qualifying distribution will default to being split evenly between the 2020, 2021 and 2022 tax years. A taxpayer can elect to have all of the income reported in 2020, which could be a wise election if they expect to be in a lower tax bracket this year than they will be in subsequent years.

Loans from Employer-Sponsored Retirement Plans

Employer-sponsored plans, such as 401(k)s and 403(b)s, may contain loan provisions. If you participate in a plan that includes a loan provision, the CARES Act expanded the availability of these types of loans in the following ways:

- Maximum loan amount increases to $100,000. The maximum loan amount that can be taken from a plan was increased to $100,000 from $50,000.

- 100% of the account value is available. Prior to the passing the CARES Act, the maximum percentage of the account value that was available for a loan was 50%. Combining these two new provisions, the maximum loan amount that can be taken from an employer plan is the lesser of 100% of the account balance or $100,000.

- Repayment delayed. Loan repayment can be delayed for up to one year on loans made through December 31, 2020.

Required Minimum Distributions (RMDs) Waived in 2020

RMDs on all retirement plans are suspended for 2020. This includes Traditional, SEP, and SIMPLE IRAs, and employer plans such as 401(k)s, 403(b)s and governmental 457(b)s. The suspension applies to both account owners and beneficiaries of inherited accounts.

If you were required to take your first RMD in 2019 (you turned 70 ½ in 2019), but delayed doing so until 2020, you no longer need to take that RMD either. Any RMD scheduled to be taken in 2020 (even those from the 2019 tax year) are suspended. In this situation, because the 2020 RMD is also waived, you will get to skip two RMDs.

If you already took your RMD for 2020 and wish to return those funds to the account to avoid paying tax, there are two possible opportunities to do so:

- 60-Day Rollover. If the initial distribution was taken within the last 60 days, you may return the funds to the account as a 60-day rollover. You are only allowed one rollover per 365-day period, so you must not have done a rollover in the prior 365 days and you will not be allowed to do one for the next 365 days.

- Coronavirus-Related Distribution. If you are already outside of your 60-day window and you are able to meet the definition for a coronavirus-related distribution, as described earlier, you would have three years to return the amount you initially distributed as an RMD. While the definition of this distribution type is very broad, it is not unlimited and not everyone will be able to qualify for it.

The above options for return of RMDs only apply to retirement account owners—they cannot be used by retirement account beneficiaries who inherited their account from a deceased retirement account owner. Beneficiaries are not eligible to do a rollover under any circumstances.

Because RMDs are not required for 2020, it will not count as a year towards the 5-year rule for retirement account beneficiaries who are non-designated beneficiaries where the account owner died prior to their required beginning date. In these cases, the 5-year rule actually becomes a 6-year rule.

Note: This change does not impact the new 10-year rule for non-eligible designated beneficiaries under the SECURE Act because no beneficiary will be using that distribution schedule until 2021.

Enhanced Tax Benefits for Charitable Contributions

There were two changes introduced by the CARES Act that improve the deductibility of charitable contributions for certain taxpayers:

- $300 above-the-line deduction. The ability to deduct charitable contributions as an adjustment to gross income (above-the-line) allows you to deduct these contributions without itemizing your deductions. In order to claim this deduction, you cannot itemize your deductions. This deduction cannot be taken for contributions to supporting organizations or Donor Advised Funds. This is a permanent change to the tax code.

- Percentage of AGI limitation increased. For the 2020 tax year, individuals can claim an itemized deduction for charitable contributions up to 100% of their AGI. Any excess may be carried forward for up to 5 years. The expanded deduction amount cannot be used for contributions to Donor Advised Funds or supporting organizations.

- The 10% limit for corporations was also increased to 25% of the corporation’s taxable income.

Student Loan Relief

There were several student-loan related provisions included in the CARES Act:

- Student loan payments deferred until September 30, 2020. Payments on Federal student loans are suspended through September 30, 2020. No interest will accrue during this time. Only required payments are suspended. Voluntary payments will continue unless individuals contact their loan provider to stop these payments.

- This period of time will continue to count toward any loan forgiveness programs.

- All involuntary debt collections are suspended through September 30, 2020.

- Employers can exclude student loan repayments from compensation. Amounts paid by an employer to an employee for the purposes of paying student debt are typically considered employee compensation and subject to tax. From January 1, 2020 through December 31, 2020, up to $5,250 of loan payments can be excluded from income. This amount will reduce the already existing $5,250 limit that employers can provide to employees tax-free for education-related expenses. The total amount of education-related expenses that are tax-free remains the same. Essentially, the definition of what is included in that amount is broadened to include student loan repayments.

Changes to Medical Expenses

- Definition of qualified medical expenses expanded. The definition of qualified medical expenses, for the purposes of Health Savings Accounts, Archer Medical Savings Accounts and Flexible Spending Accounts, is expanded to include over the counter medications and menstrual care products.

- Medicare beneficiaries will receive COVID-19 vaccine at no cost, once available.

- Part D recipients can request 90-day supplies of prescriptions.

- Telehealth services may be temporarily covered by HSA high deductible health plans before the deductible is met.

- Rules for providing telehealth services are relaxed during the COVID-19 emergency period.

Unemployment Compensation Benefits Expanded

Below are the key provisions related to unemployment coverage:

- Pandemic Unemployment Assistance. Self-employed individuals and others who are typically ineligible for unemployment or have run out of such insurance will be eligible for up to 39 weeks of benefits due to this provision.

- Federal Government will cover first week of unemployment. People are usually ineligible to receive unemployment the first week that they are unemployed. The Federal Government has offered to pay states to provide unemployment compensation immediately, foregoing the one-week waiting period.

- Regular unemployment compensation is increased by $600 per week. States have the ability to increase the unemployment benefits they pay by up to $600 per week for up to four months using Federally provided dollars. This will meaningfully increase the amount of money an individual may receive through unemployment, as the national average weekly benefit is under $400 per week.

- Unemployment compensation is extended by 13 weeks.

Provisions for Business Owners

Paycheck Protection Program and Forgivable loans

The CARES Act contains several potentially significant benefits for small business owners. One of the most significant is the Paycheck Protection Program paired with a forgivable loan provision.

- The Paycheck Protection Program is a loan program that allows lenders to issue Small Business Administration (SBA) 7(a) small business loans up to a maximum of $10 million or 2.5 times the average monthly payroll costs over the previous year to businesses that have fewer than 500 employees.

- The definition of business includes:

- Sole proprietorship

- Food service business that employs fewer than 500 people per physical location

- The definition of business includes:

- The loan proceeds may be used for

- Payroll costs (gross wages, bonuses, commissions, employer group benefits and retirement plan contributions and state payroll taxes)

- Group health insurance premiums or other healthcare costs

- Rent

- Mortgage interest, excluding pre-paid amounts

- Utilities

- Other business interest incurred prior to February 15, 2020

- Borrowers are required to make a good-faith certification that the loan is necessary due to the uncertainty of current economic conditions caused by COVID-19.

- Loan forgiveness

- The amount of the loan eligible to be forgiven is the amount spent during the first 8 weeks after the loan is made on the following items:

- Payroll costs, excluding amounts for individuals with compensation greater than $100,000

- Rent due to a lease in force prior to February 15, 2020

- Electricity, gas, water, transportation, phone and/or internet access for services which began before February 15, 2020

- Group health insurance premiums and other healthcare costs

- The loan amount forgiven is limited to the eligible amount (based on the expenses listed above) times the percentage obtained by dividing:

- The average number of full-time employees (FTEs) per month employed during the covered period by (borrower’s choice):

- The average number of FTEs per month employed during the period February 15, 2019, through June 30, 2019, or

- The average FTEs during the period January 1, 2020, through February 29, 2020.

- If this requirement is not met, the loan forgiveness is reduced on a pro-rata basis.

- Additional reductions will be incurred if employees with compensation under $100,000 have their compensation cut by more than 25% when compared to the most recent quarter.

- The average number of full-time employees (FTEs) per month employed during the covered period by (borrower’s choice):

- Any debt forgiven is not included in taxable income

- The maximum interest rate on loans issued under this program is 4%. However, guidance issued to borrowers from the Treasury Department has set the loan interest rate at 0.5%.

- The Act allows for a maximum length of the loan of 10 years.

- Payments will be deferred no less than six months and no longer than one year.

- The amount of the loan eligible to be forgiven is the amount spent during the first 8 weeks after the loan is made on the following items:

Employee Retention Credit

Many businesses have been forced to reduce their hours or services or close their doors altogether. As an incentive to encourage businesses from making further layoffs, the CARES Act provides a new payroll tax credit.

To be eligible for the credit:

- The operations of the company need to have been fully or partially suspended due to governmental intervention because of the coronavirus OR

- Revenue in 2020 was less than 50% of the revenue from the same quarter in 2019

- For businesses that meet one of the above requirements, they will continue to qualify for the credit until the earlier of:

- December 31, 2020 or

- there is a quarter without a government-required suspension of operations OR

- gross revenue from the current quarter exceeds 80% of gross revenue from the same calendar quarter in 2019, whichever is sooner.

The credit is equal to 50% of wages paid to each employee, up to a maximum of $10,000 of wages per employee.

- Business with 100 or fewer employees will have all wages count towards the credit.

- For employers with more than 100 employees, only wages paid to individuals who are not working during the shutdown (or decline in revenues) are eligible to count towards the credit.

- Wages include health benefits in both cases.

This provision is not available to businesses who participate in the SBA loan forgiveness program.

Payment of Payroll Taxes Deferred

Employers are eligible to defer payroll taxes due from March 27, 2020 through December 31, 2020.

50% of the payroll tax liability is due December 31, 2021 and 50% is due on December 31, 2022. This relief also applies to the employer portion of self-employment taxes.

Payroll taxes can be a significant liability to a business. The ability to defer these tax payments could significantly boost the short-term cash flow picture of companies that may otherwise be struggling in the current environment.

This provision is not available to businesses who participate in the SBA loan forgiveness program.

Net Operating Loss Carrybacks

Net operating losses (NOL) that were accrued in 2018, 2019 or 2020 can now be carried back up to five years. Unused losses can still be carried forward indefinitely. NOLs are also able to offset up to 100% of taxable income in 2018, 2019 and 2020 (up from 80%).

These changes allow companies with NOLs to amend their prior years’ returns to claim refunds of amounts previously paid to further enhance their current cash flow picture.

For non-corporate taxpayers, the limit on the amount of cumulative business losses that a taxpayer may claim has been suspended for 2018, 2019 and 2020. Previously, those limits were an inflation-adjusted $250,000 for single filers an $500,000 for joint filers. Taxpayers with suspended business losses should consider filing amended returns to claim additional losses in those tax years. Doing so could help their current cash flow situation, assuming a refund is due.

Minimum Tax Credit is Accelerated

The CARES Act allows business to claim outstanding Minimum Tax Credits (MTCs) starting in 2019 (originally 2021). In other words, the CARES Act allows corporations to claim 100% of AMT credits in 2019. The option also exists to make an election to take the entire refundable credit amount in 2018. The application for a tentative refund must be filed before December 31, 2020.

Deductibility of Interest Expense Temporarily Increased

The CARES Act retroactively increases the limitation of the deductibility of interest expense from 30% to 50% for the 2019 and 2020 tax years. If you are a partner in a partnership, special rules apply that are beyond the scope of this article.